The recent buzz around Costco’s venture into selling gold bars has captured the attention of both casual and serious investors. Gold, with its enduring allure and historical significance, has always been a coveted asset. However, before diving into this glittering trend, it’s important to understand the nuances of gold investment, particularly in the context of Costco’s offerings.

Gold’s Timeless Appeal

Gold has been revered for its beauty and rarity for millennia, often symbolizing wealth and power. Its role in human history is profound, serving as a cornerstone in financial systems and a symbol of prosperity. Today, gold continues to hold a prominent place in investment portfolios for several reasons:

- Tangible Asset with Inherent Value: Unlike stocks or bonds, gold is a physical commodity with intrinsic worth, unaffected by market volatility and economic downturns.

- Diversification and Risk Mitigation: Gold bars provide a unique way to diversify an investment portfolio. Gold typically doesn’t correlate with the movements of traditional financial assets, often acting as a safe haven during market turbulence or inflationary periods.

- Hedge Against Inflation: Gold has historically been an effective hedge against inflation, maintaining purchasing power even when currency values decline.

- Liquidity and Easy Storage: Gold bars, especially 1-ounce ones, are highly liquid and require minimal storage space.

- Global Acceptance: Gold’s value is recognized worldwide, transcending geographical and economic boundaries.

- Long-term Appreciation: Over time, gold has shown a consistent ability to appreciate in value, making it a reliable choice for wealth building.

Why People Love Costco’s Gold Bars?

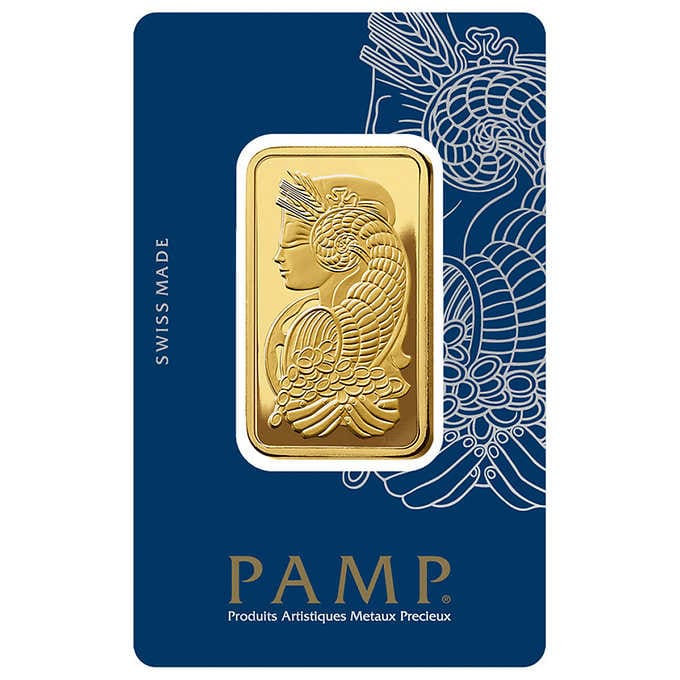

The surge in purchases of Costco’s gold bars can be attributed to a combination of factors. Firstly, the allure of gold as a tangible asset with inherent value and historical significance plays a significant role. People are drawn to the idea of owning a physical, universally recognized commodity that has traditionally been a symbol of wealth and stability. Secondly, Costco’s reputation for offering high-quality products at competitive prices adds an element of trust and accessibility to the purchase of gold bars, a market typically dominated by specialized dealers. This, combined with the convenience of online purchasing, has made these gold bars particularly appealing to both seasoned and novice investors. Additionally, if you have Costco’s Executive Membership and then purchase the gold bars with a credit card to earn cash back, you can actually pay less upfront and will likely make profit when selling the bars. Just make sure to check if your state taxes the purchase. Costco’s entry into this market has capitalized on these factors, making gold investment more mainstream and appealing to a broader customer base.

Why You Should Not Invest In Costco’s Gold Bars?

While investing in gold bars can be advantageous, there are specific considerations when it comes to purchasing them from Costco:

- Subpar Long-Term Returns Compared to Stocks: Historically, the returns on gold investments have been modest, especially when compared to stock market investments. Over extended periods, indices like the S&P 500 have outperformed gold in terms of average annual returns.

- Storage and Security Concerns: Owning physical gold necessitates secure storage and possibly insurance, which adds to the cost and complexity of the investment.

Alternatives to Physical Gold Investment

Investing in gold doesn’t necessarily mean owning physical bars or coins. Gold ETFs (Exchange-Traded Funds) offer a more practical alternative:

- SPDR Gold Shares (GLD): This fund owns physical gold and tracks its price, allowing for investment in gold without the challenges of physical storage and security.

- Eliminating Physical Bullion Issues: Gold ETFs remove the need for secure storage and insurance, offering a more straightforward way to invest in gold.

The Bottom Line

Costco’s foray into selling gold bars has undoubtedly stirred interest among investors. While gold bars can be a wise addition to a diversified investment portfolio, they also come with unique challenges. It’s vital to consider factors like pricing, potential returns, and practical aspects of owning physical gold. As with any investment decision, thorough research and alignment with your overall financial goals are essential. Gold, whether from Costco or other sources, can be a valuable asset, but it should be approached with careful consideration and understanding of its role in your broader investment strategy.