Cryptocurrencies are evidently the most disruptive development in human experience in the course of the last twelve months. The impact of Bitcoin and the line-up of altcoins has been felt around the world in a remarkable way.

Individuals, corporations, and financial institutions have been impacted by the rise of blockchain technologies. In several facets of financial transactions, the way business is carried out is changing, and there are several points to take note of and evaluate.

Let us identify the areas of banking that have been impacted and explore those changes in depth.

Money Transfers Redefined

The way money is transferred from one person to another is an area that cryptocurrencies have greatly impacted. At present, there are over 1,580 active cryptocurrencies. Each of those is available for use in transactions.

Global commerce is an area where the transfer of cryptocurrencies has become widespread. A few years ago, cross-border payments for goods and services were bank-driven. Now, you can run a search for merchants that accept cryptocurrency and place your order through them, avoiding having to use a banking platform.

The ease of transfer that cryptocurrency users enjoy is an incentive for many, as you only need to enter your recipient’s wallet address to make a payment. In simple terms, any transaction carried out on a crypto-accepting platform deprives a bank of the value of the transaction and its related charges. Any person with a digital wallet can hold, send and receive payments painlessly.

Depleted Savings Accounts

Despite the uncertainty that is associated with the market price of cryptocurrencies, many people are getting used to its volatility. Many crypto enthusiasts are emptying out their savings accounts to buy Ethereum, Dash, and other altcoins.

While price surges can lead to returns of up to 50 percent on crypto, an entire year’s interest on a savings account might be negative, or peak at 5 percent in the healthiest of economic climates. In view of the clear contrast between the rate of return, banks are losing out, as clients find a new destination of choice for idle funds.

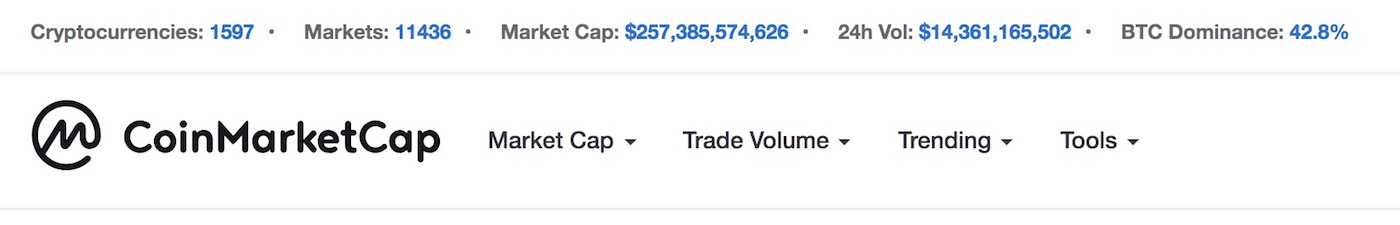

Admittedly, not all people are swayed by the prospects of the high rates of return on crypto, but the growing army of optimists record $15 billion in daily transactions across various cryptocurrencies.

See this CoinMarketCap image for a snapshot of the midday transactions as of June 25, 2018.

To the crypto adherent who is willing to take a risk in hopes of better returns, buying any of the chart leaders makes a lot of business sense. The rise of paper and other offline wallets makes it even more alluring for a Bitcoin buyer to store some coins safely. With this rise in popularity of cryptocurrency investment, you can be sure that savings accounts are taking a beating.

Doing the Banks a Favor

Cryptocurrencies are disrupting banking as a two-way traffic system. While cryptocurrency wallets are proving to be an alternative to traditional banking services for many users, the banks still retain a big piece of the pie. Find out more on this checking Ethereum news. Global banking is largely driven by corporations and governments; they move funds regularly on an international basis for a variety of reasons.

SWIFT has long been the backbone of global money transfer for many reasons, and the service is not cheap. As an individual, executing a SWIFT transfer can take off $30 off your bank balance. On the contrary, Ripple charges less than $1 for a money transfer.

The contrast between this traditional means of funds transfer and the altcoin option does not stop at fees; the former lags far behind the latter in terms of time. Ripple can deliver your transfer internationally in a matter of minutes, while SWIFT transfers take 1-3 days. Every banking transaction costs at least $20 less when using RippleNet, which could save banks an average of 60 percent on settlement costs if they adopted the new system.

No Transaction Size Limits

One of the most notable facets of cryptocurrencies’ disruption to global banking is the issue of transaction limits. Some transactions are downright illogical to carry out on banking platforms as a result of size limits. There are constraints with respect to micro and minute payments.

Transaction scalability is one area where cryptocurrencies can greatly exceed the expectations of traditional bank users. Sometimes micropayments need to be made, and as a result of minimal transaction sizes, these payments are impossible (or highly impractical). However, with cryptocurrencies, payments can be made to the decimal. Dogecoin made early headlines for emerging as the first payment means for social media tips.

At present, it does not matter if you only need to pay the equivalent of 5 cents to someone – crypto makes this possible, anywhere on earth. The real-time and instantaneous nature of blockchain technology has made it possible to perform micro-payments to someone in a distant region within seconds.

In the early days of Bitcoin, the significant delays involved with transactions were a big disincentive to use the cryptocurrency for payments. Now, several options exist that guarantee instant receipt, at any time of the day. This eliminates the need to deal with limitations associated with banking hours or clearinghouse delays. With cryptocurrencies, a variety of options are making fast and efficient transaction settlements a reality.

Transactions without Borders

The global banking system recognizes national and international borders for financial transactions. These curbs exist as a result of regulation and the demands of sovereignty. However, the blockchain has reduced the world to a global village, where the only boundaries are those defined by the device you hold and the platform you are using.

Anyone with Internet access can send, receive, and monitor cryptocurrency transactions with ease. Perhaps more interesting is the fact that several cryptocurrencies already exist for particular solutions and services. There are specially designed options available for money transfers, real estate, online gaming, database management, bill discounting, travel loyalty schemes, and much more.

The variety of options cryptocurrency options that exist makes it easy to find solutions that meet your individual needs. In many ways, fiat money is losing steam on a gradual basis, and since banks are directly tied to money flows, their influence and popularity will wane as time goes on.

There is no doubt that there is still some skepticism surrounding cryptocurrencies, and like most innovations, progress will only be gradual. In the early days of the Internet, nobody ever imagined that Internet banking would become a global norm, but today, Internet banking is the international standard. In the same vein, it might be worth taking note of this anonymous dialogue:

- What is the future of banks?

- There are no banks in the future.

Disclosure: We might earn commission from qualifying purchases. The commission help keep the rest of my content free, so thank you!