My oil furnace was coming to the end of its life when I moved to my current house. It was more than 40 years old while oil furnaces’ lifespan is around 15-30 years old, depending on how well-maintained they are. Besides, I hate paying ~$4,000 per year for oil deliveries, so there is no better time to replace it with a more energy-efficient system. Since natural gas is not available in my area, the best solution would be an electric heat pump as it is expected to reduce carbon emissions as well as the energy cost.

I got a few quotes from local HVAC companies and was shocked with their estimates. The total costs range from $22,000 to $30,000 which is way above my budget, even after all the state rebate and federal tax credit. If you haven’t heard about the tax credit, you can claim 30% of project cost up to the annual total limit of $2,000. This applies to heat pumps purchased and installed between January 1st, 2023 and December 31st, 2032.

As hiring a contractor became unaffordable, I had to find out DIY solutions and fortunately there are a few options out there. I ended up buying the MRCOOL DIY Ductless Mini-Split Heat Pump System. Before ordering a heat pump, you should always check if it qualifies for the 30% tax credit because there are actually some strict conditions. If you are unsure about this, consult a tax professional to verify the eligibility.

According to IRS, the heat pump must meet or exceed the highest efficiency tier (not including any advanced tier) established by the CEE (Consortium for Energy Efficiency) that is in effect as of the beginning of the year. In this case, I installed the heat pump in 2023 and here are the guidelines for ductless mini-splits coming from the CEE Residential Electric HVAC Specification document:

North and Canada

- SEER2 16.0

- EER2 ≥ 9.0

- HSPF2 ≥ 9.5

- Heating COP at 5°F ≥ 1.75

South

- SEER2 ≥ 16.0

- EER2 ≥ 12.0

- HSPF2 ≥ 9.0

The North and Canada region includes Canada and these states: Alaska, Colorado, Connecticut, Idaho, Illinois, Indiana, Iowa, Kansas, Maine, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New York, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, Vermont, West Virginia, Wisconsin, and Wyoming. The South Region includes Alabama, Arizona, Arkansas, California, Delaware, the District of Columbia, Florida, Georgia, Hawaii, Kentucky, Louisiana, Maryland, Mississippi, Nevada, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, and Virginia.

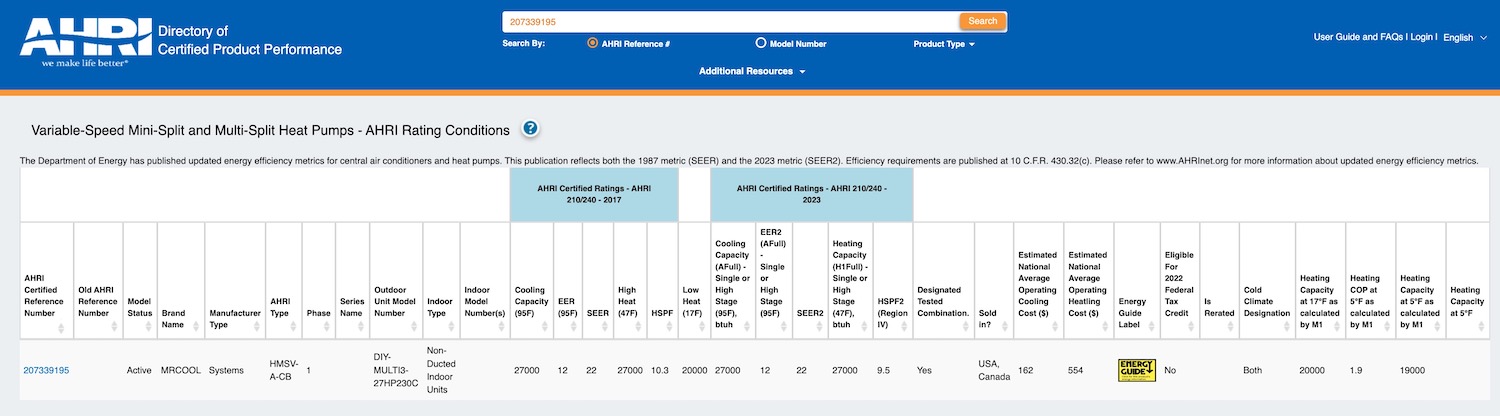

Many MRCOOL systems do not meet the efficiency requirements and therefore, don’t qualify for the federal tax credit yet; You should always check ENERGY label before making the purchase. For instance, the MRCOOL DIY 4-Zone 36,000-BTU mini split has the SEER2 of 21.5, EER2 of 10.5, HSPF2 of 8.8, and heating COP of 2; The HSPF2 is lower than 9.5, so you can’t claim tax credit for this system in the North. To check which system qualifies, you can visit the rebate center on MRCOOL’s website. Another way is to look it up on AHRI Certification Directory, the AHRI reference number of a specific model can be found on MRCOOL’s website.

Disclosure: This article is for reference only; I do not provide tax, legal or accounting advice, so you should always do your own research and consult your tax advisor.

Disclosure: We might earn commission from qualifying purchases. The commission help keep the rest of my content free, so thank you!